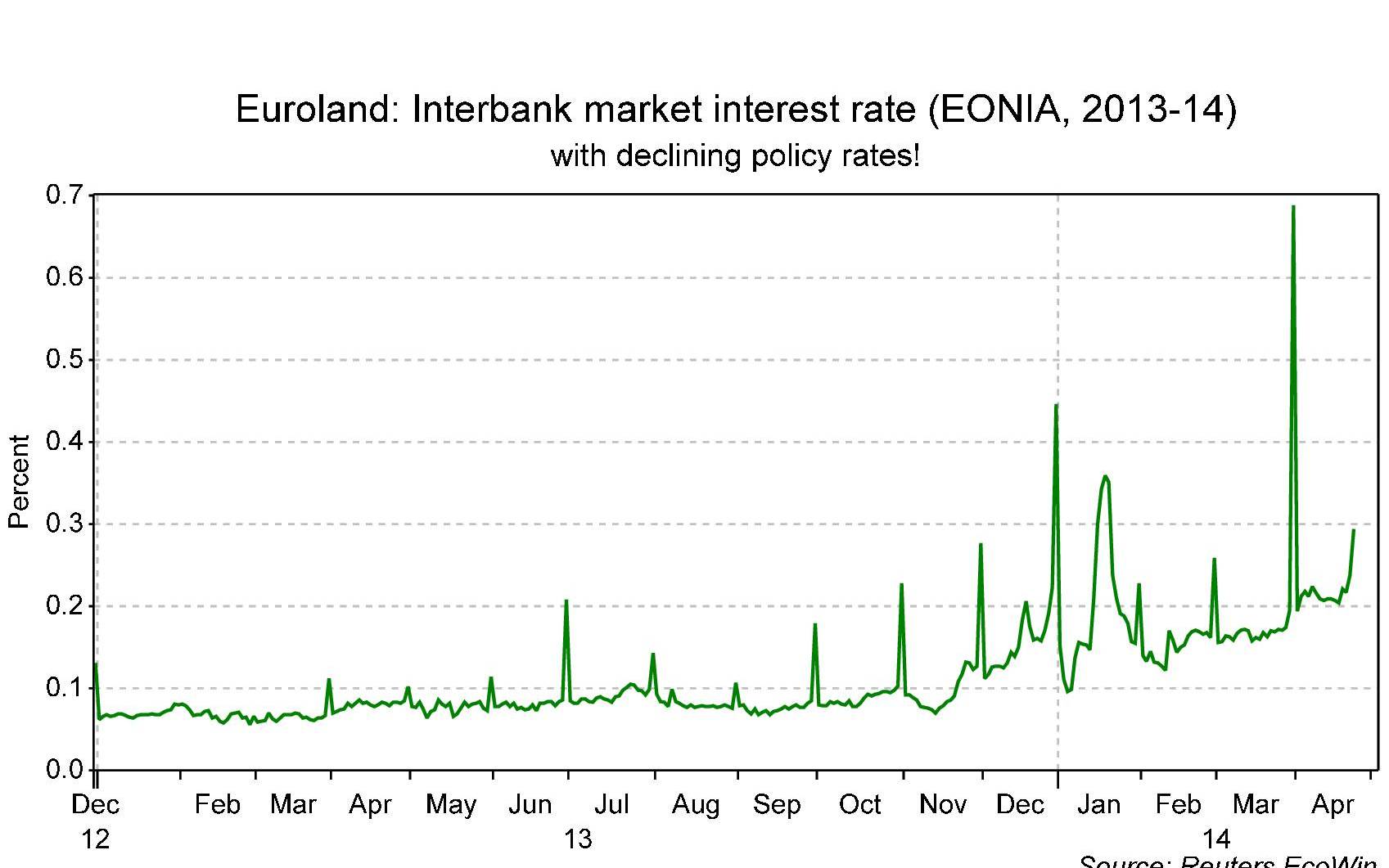

Mario Draghi’s “historical measures” (as defined by Bloomberg) are best seen as ways to restore the interbank rate of interest (EONIA) that prevailed throughout 2013, when the interest rate that banks paid each other for lending and borrowing liquidity (aka “reserves”) had stabilized a few basis points above zero.

This rate is the main policy-driven rate that shapes all money market rates. A super-low and stable EONIA had been the outcome of two ECB measures in 2012: the VLTROs and the Deposit Facility rate cut to zero.