17 November 2014: Interview for share radio

Category: Blog

Searching hard for Taylor’s inflation

In February 2011, I was in the audience of a lecture given by John Taylor on the “exit strategy”. One main theme was that the policy of the Fed called “Quantitative Easing” meant a high risk of monetization and inflation, if not hyper-inflation, in the U.S. economy. In the Q&A session, I asked Professor Taylor why he thought that “monetization” is inflationary. I argued that Quantitative Easing boils down to portfolio shifts in banks’ balance sheets, and that asset reallocation does not seem to be causing an increase in demand, nor a price increase. Read more

Letter to The Economist

SIR – You described the ECB as moving forward at “breakneck speed”, while businesses and workers in the Eurozone are not doing likewise (“Busy, busy”, September 4th). But more should be said about the trajectory along which the ECB seems to be advancing so quickly. As the ECB embarks on QE, you note that the ABS market is “simply too small” to boost growth and the sovereign bond market, while large enough, is politically unfeasible.

I would raise a more fundamental question: What does the ECB expect to achieve by removing (from banks’ balance sheets) assets carrying positive yield and replacing them with “reserves” (that now yield a minus 0.2%)?

The notion that QE encourages bank lending and that reserves multiply into bank loans is flawed. A number of academic and practitioner articles have dispelled the myths surrounding money creation and QE. If this is true, then the ECB may be moving at “breakneck speed” toward a brick wall.

A savings trap. Not a liquidity trap.

Today, on Social Europe Journal, why Europe’s policies still head in the wrong direction.

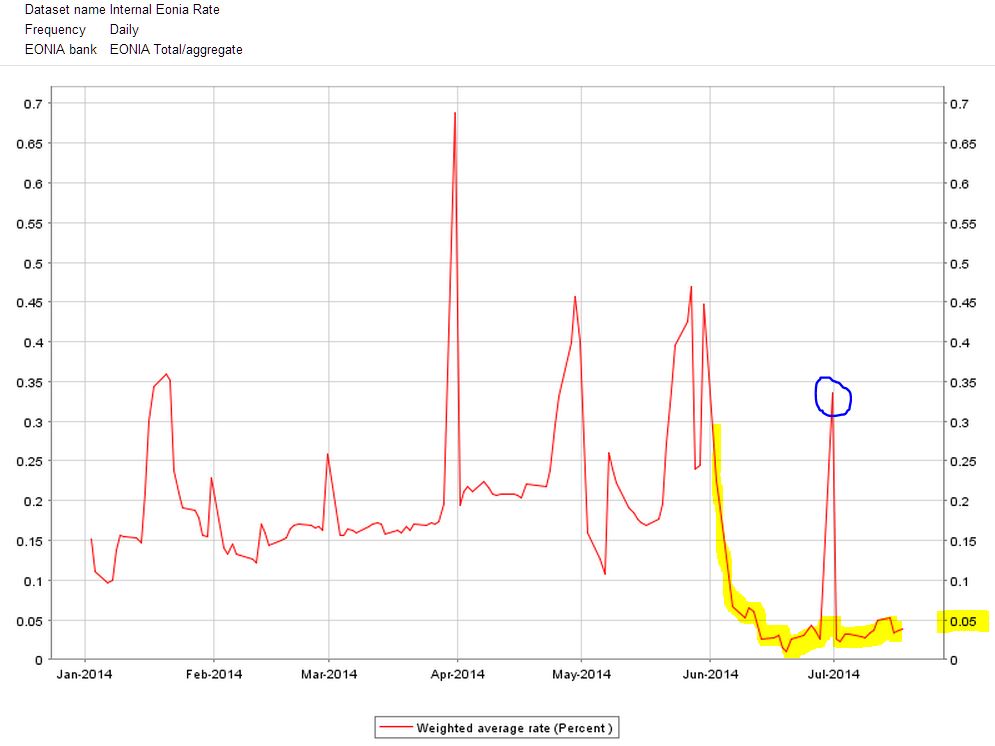

ECB drives rates below 0.05%: And now what?

The move of the ECB on June 5 was primarily aimed at restoring conditions of low and stable money market rates.

It was not difficult to predict (as I did here six weeks ago) the direct consequences of the new official rates and, notably, of the prolongation of fixed rate, full allotment tender procedures, and of the decision to suspend the weekly fine-tuning operation sterilising the liquidity injected under the Securities Markets Programme.

Except for the end-of-June spike, money market rates appear more stable and lower.