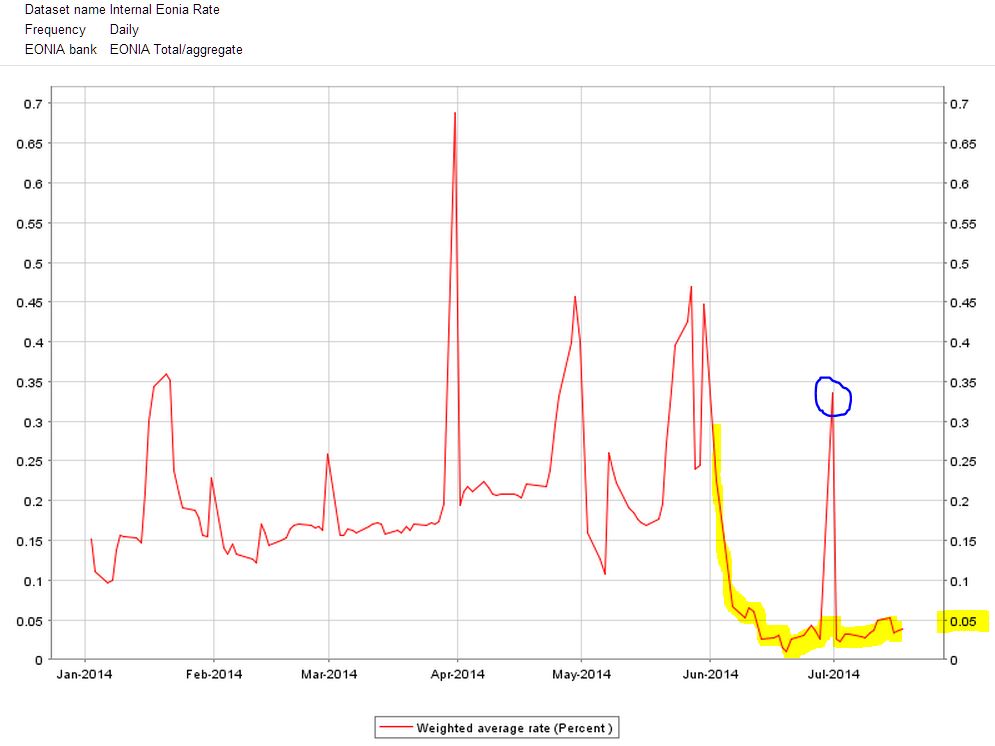

The move of the ECB on June 5 was primarily aimed at restoring conditions of low and stable money market rates.

It was not difficult to predict (as I did here six weeks ago) the direct consequences of the new official rates and, notably, of the prolongation of fixed rate, full allotment tender procedures, and of the decision to suspend the weekly fine-tuning operation sterilising the liquidity injected under the Securities Markets Programme.

Except for the end-of-June spike, money market rates appear more stable and lower.

Technically successul, this policy move is not likely to succeed in raising inflation, or ending Eurozone stagnation.

The logic of moving market rates close to zero builds on the hypothesis that the Eurozone is in liquidity trap.

The reality is that the Eurozone is in a savings trap. Escaping from a savings trap requires the end of austerity now.