Awaiting tomorrow’s ECB decision, it’s worth restating the main issue the ECB is facing.

Not much has changed since April: The ECB is still having trouble controlling interest rates.

Given that the ECB believes that super-low interest rates will bring inflation back to close to 2%, it is not happy that the EONIA interbank rate has moved up.

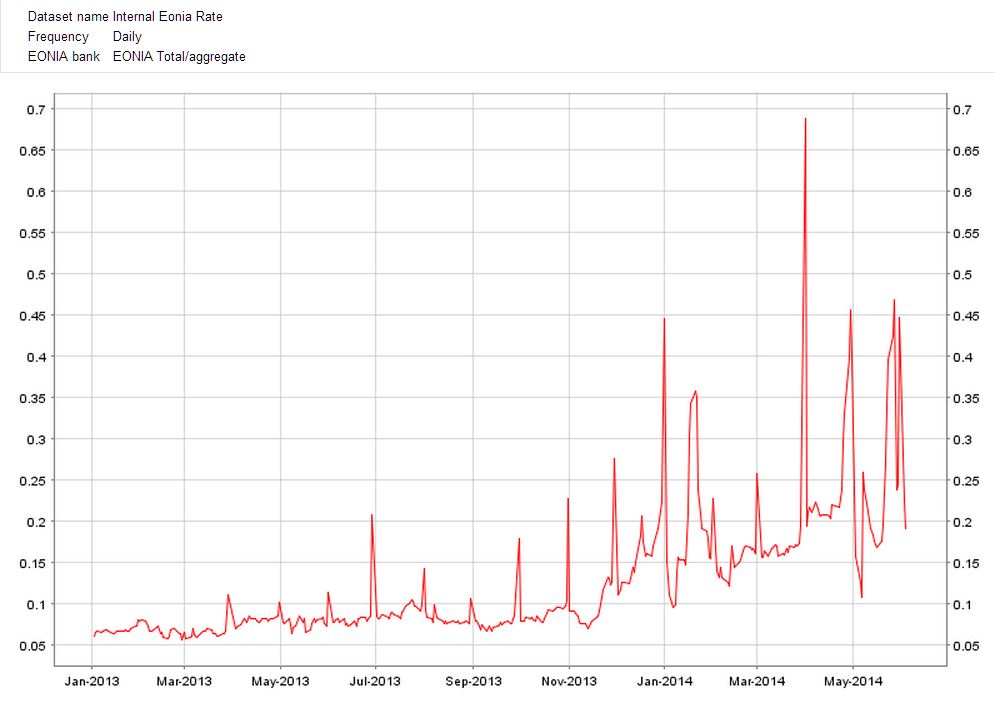

In 2013, EONIA has always been below 0.1%, with very few and brief exceptions, and in 2014 it has so far been the opposite: EONIA has always been above 0.1%.

This has occurred at the same time as bank reserves have declined over 80% from their 2012 peak, as European banks are early returning the funds they borrowed through the 2012 LTROs. And look what’s happening to interest rates in the Figure below (Source: ECB).

Not only EONIA is higher than what the ECB would wish it was, but it is also much more volatile.

So, the ECB’s main mission is to:

a) decide what EONIA level it wishes (probably the same as in 2013, or 0.10-0,15%);

b) take action to stabilize EONIA again around that level (as in 2013).

Technically, there are different options. We’ll hear tomorrow which one the ECB has chosen.