Mario Draghi says ECB is open to asset purchase to battle low inflation

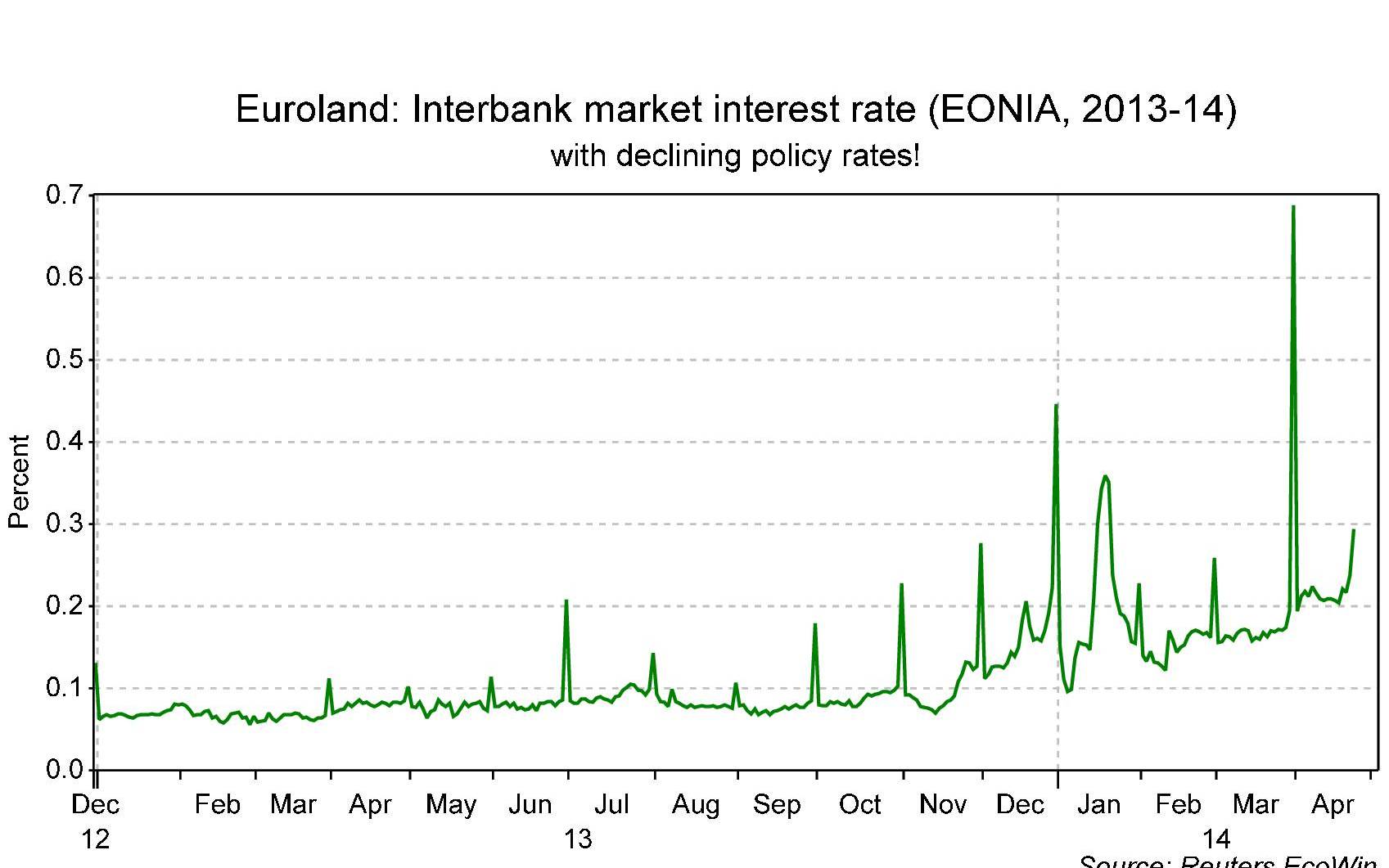

The current concern of the ECB these days is illustrated below: The ECB is having a hard time controlling interest rates!

The upward trend and volatility of the interbank rate reveals a failure to control the market interest rate using policy rates.

The ECB then considers providing more “excess reserves” to the banking system in the attempt to pull the interbank market rate south.

In summary:

1. The ECB believes it can bring inflation back to close to 2% with low interest rates, and they would like to see the interbank rate at or below 0.1%.

2. It believes this is a way to add to demand.

3. And it believes this is also a means to weaken the euro against the U.S. dollar.

4. Yet, the ECB is having a hard time achieving this goal (see the upward trend of the market rate on the chart) because some banks continue to struggle to get liquidity to fulfill reserve requirements (notice the once-a-month peaks on the chart).

5. Adding “excess” reserves should do the job.

The real issue here is not QE. The real issue is the effectiveness of a 0.1% interest rate. Will it add to demand? Will it weaken the euro?

My answer to both questions is very little, if at all. But this is a question for another post. The point here is that the ECB undertakes QE because policy rates are not being effective to control the market interest rate.